Company: OTP bank Serbia

Industry: Finance

Challenge

OTP banka Srbija is the largest creditor of the economy and the population and has a leading position in the factoring, leasing and e-commerce services markets. OTP Bank’s presence, with 155 branches and 266 ATMs in 91 municipalities throughout Serbia, provides customers with efficient services and offers tailored to their needs at almost any time. With its commitment to providing a wide range of universal banking products and services, the bank is constantly striving to offer new solutions within the banking sector. However, in order to remain competitive, the Bank is constantly optimising its processes and using new technologies.

Solution

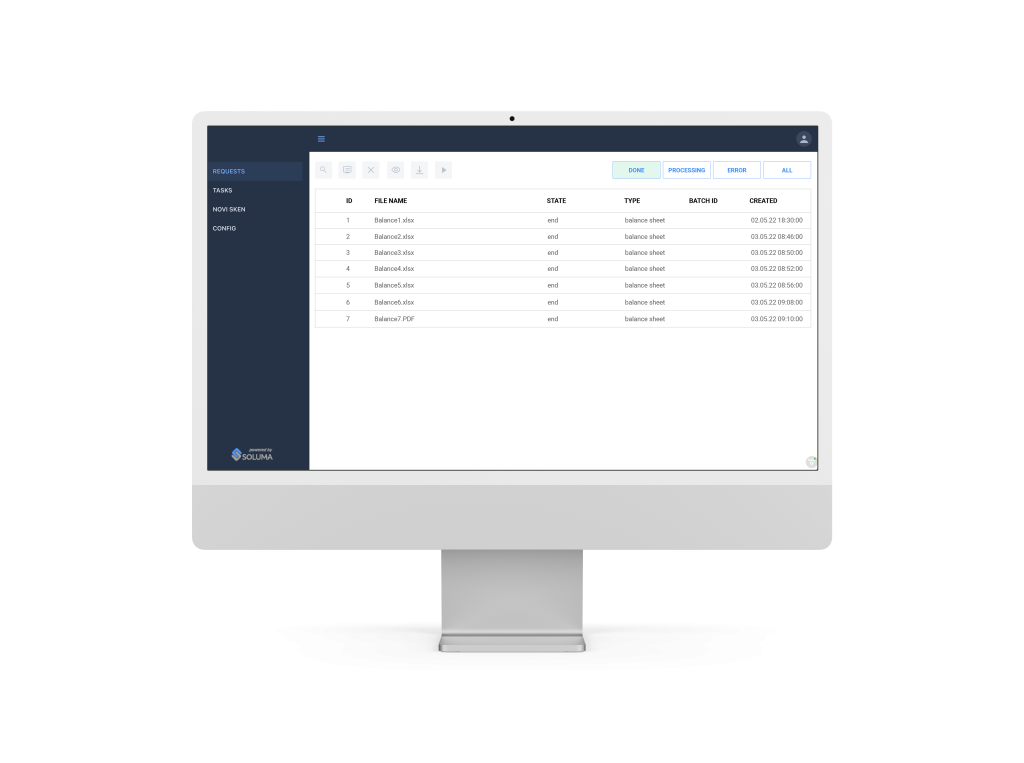

Soluma’s BS Reader (Balance Sheet Reader) is an adaptable solution specifically designed to simplify the process of processing gross balance sheets (balance sheets and profit and loss accounts). This sophisticated tool efficiently analyses gross balance sheets and converts them into comprehensive reports, thus providing an overall view of the company’s performance.

One of the key features of Soluma’s BS Reader solution is its advanced Optical Character Recognition (OCR) capability, based on ABBYY OCR technology, which enables the software to accurately extract data from the gross balance, eliminating the need for manual data entry.

In addition, Soluma’s BS Reader offers the convenience of exporting reports in universally compatible formats such as PDF and Excel. This versatility allows users to share reports, ensuring seamless communication and collaboration with stakeholders.

Whether it’s creating edited PDF reports or using the data-rich features of Excel for further analysis, Soluma’s BS Reader provides users with flexible reporting options tailored to their needs.

Result

Thanks to Soluma’s software, OTP banka Srbija has achieved significant time savings in gross balance processing. What used to take 30 minutes can now be completed in just five minutes thanks to the simplification and automation of the process enabled by the software. This significant time saving not only increases operational efficiency, but also enables the bank to allocate its resources more efficiently. In addition to saving time, Soluma’s software reduces the reliance on manual data entry and analysis.

In addition, Soluma’s software gives banks the flexibility to customise reports according to specific requirements. This is particularly valuable given the frequent and rapid changes in legislation. Banks such as OTP banka Srbija can use the software’s customisable features to easily adapt and update reports to meet new requirements, ensuring compliance and maintaining the accuracy of their financial statements.

All in all, Soluma’s software has enabled OTP Bank Srbia to operate even more efficiently thanks to time savings and adaptability to regulatory requirements, enabling the bank to optimise the balance sheet processing process and increase overall operational efficiency.